Buying a home on a tight budget can feel like a minefield. Listings look similar, prices jump around, and the “cheap” option sometimes turns into the most expensive one after delivery, setup, repairs, and monthly fees.

Manufactured housing can be one of the smartest paths to homeownership if you shop it the right way. The key is separating a genuinely good deal from a low sticker price that hides big costs later.

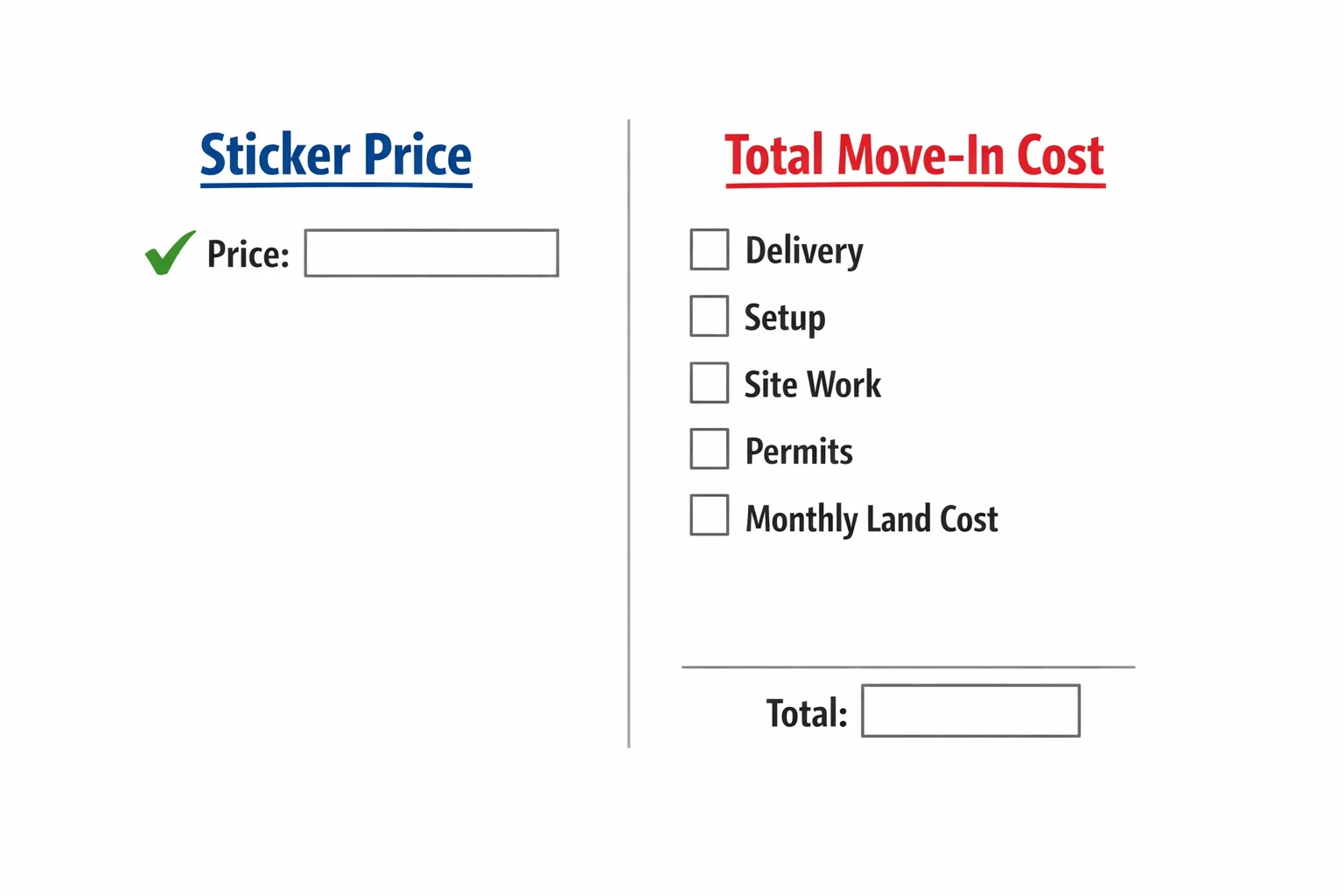

“Cheap” should mean low total cost, not just a low listing price

When people search for cheap manufactured homes for sale, they usually mean “the lowest price I can find.” A smarter definition is: the lowest total cost to get into a safe, comfortable home you can keep long term.

Two homes with the same sales price can have very different real costs depending on:

- Where it will be placed (private land vs a land-lease community)

- What is included (delivery, setup, skirting, steps, AC, appliances)

- Condition (especially for used homes)

- Financing terms

If you only compare listing prices, you are comparing the least important number.

Build a budget that includes the costs people forget

A manufactured home purchase often has “one-time” costs and “monthly” costs. Before you tour homes, write down both. It helps you avoid falling in love with a floor plan that does not fit your actual monthly reality.

Here is a practical budgeting framework you can use.

| Cost type | What it typically includes | Why it matters |

|---|---|---|

| Home price | Base price of the home (varies by model and options) | The headline number, but not the whole deal |

| Delivery and setup | Transport, blocking or foundation type, tie-downs, leveling | Can be a major part of the total cost |

| Site work (if on private land) | Clearing, driveway, pad, utility trenching, septic or sewer connection | Often the biggest “surprise” cost |

| Permits and inspections | Local requirements vary | Delays and added fees if missed |

| Insurance | Homeowners and sometimes flood coverage | Lenders and communities may require it |

| Taxes and registration | Depends on titling and whether it is classified as real property | Impacts monthly payment and closing |

| Monthly land cost | Lot rent (if in a community) or property taxes (if on land) | A low-priced home can still be expensive monthly |

| Utilities | Electric, water, sewer, trash, internet | Efficiency and setup quality affect this a lot |

If you are shopping in the San Antonio area, you will also want to think about heat-related utility costs. A slightly higher purchase price can be “cheaper” over time if the home is better sealed and insulated.

To understand what to look for in efficient models for Texas conditions, see Homes2Go’s guide to energy-efficient manufactured homes.

Know what drives manufactured home prices (so you can cut costs strategically)

If you want a cheaper home, it helps to know which choices actually move the price.

| Price driver | What usually increases cost | How to keep it cheaper without regret |

|---|---|---|

| Size and layout | Larger square footage, extra bathrooms, open-concept upgrades | Consider 2 bed / 2 bath layouts that still feel spacious |

| Finish level | Premium cabinets, upgraded fixtures, built-ins | Upgrade only what is hard to change later (floors, insulation) |

| Delivery distance | Longer transport routes, difficult access | Choose a site with easier access, confirm routes early |

| Setup type | Permanent foundations, complex site conditions | Get a site evaluation before committing |

| Climate features | Better windows, insulation, tighter ducts | Prioritize efficiency where it affects comfort and bills |

| Condition (used homes) | Deferred maintenance, roof issues, subfloor damage | Pay for inspection or walk away fast |

A common “cheap mistake” is paying extra for cosmetic upgrades while ignoring the parts that impact comfort and ongoing costs (duct sealing, insulation levels, window quality, HVAC condition).

Where to find cheap manufactured homes for sale (and how to choose the best channel)

There are several ways to shop, and each one has tradeoffs. “Cheapest” depends on your timeline, your risk tolerance, and whether you need financing.

| Shopping channel | Best for | Watch-outs |

|---|---|---|

| Retailer (new homes) | Predictability, model selection, support through the process | Compare what is included in the quote (delivery, setup, options) |

| Land-and-home package | Buyers who want one coordinated plan for land plus home | Confirm site work scope and what is included |

| Community placement | Buyers who want amenities and a simpler move-in path | Understand lot rent, rules, fee increases, and approval requirements |

| Private-party used sale | Lowest upfront price potential | Title issues, hidden damage, fewer protections |

| Repo / auction | Possible discounts | Condition can be unknown, financing can be harder |

If you are weighing private land vs community living around San Antonio, Homes2Go covers the decision points in their mobile home buyer guide.

And if you want a structured way to combine land plus home, start with the land-and-home packages guide.

Use a “deal filter” to quickly spot listings worth your time

When you are scrolling listings, your goal is to eliminate the risky ones fast, then spend your energy on the best candidates.

A listing is usually worth a closer look when it clearly answers:

- Year built (important because modern manufactured homes are built to the federal HUD Code)

- Location and placement (private land, community, or “must be moved”)

- What is included (appliances, AC, skirting, steps, setup)

- Condition disclosure (especially roof, plumbing, floors, and any prior water damage)

- Title status (for used homes, avoid vague answers)

If the listing is missing most of this, treat it as a lead, not a deal.

The biggest traps that make a “cheap” manufactured home expensive

Here are the most common cost bombs that show up after buyers get excited about a low price.

1) “Must be moved” homes with underestimated moving and setup costs

Moving a manufactured home is specialized work. If a used home is priced extremely low, it may be because the seller is trying to avoid the complexity and cost of relocation.

Before you commit, you need clarity on access, distance, setup requirements, and the condition of the home for transport.

2) Title problems (especially with private-party used homes)

A clean transfer matters for financing, registration, and future resale. If a seller cannot clearly explain the title situation, pause.

For Texas buyers, the Texas Department of Housing and Community Affairs provides manufactured housing resources through TDHCA. (Confirm title and statement of ownership requirements for your situation.)

3) Community fees and rules you did not plan for

In land-lease communities, lot rent is only one piece. Ask what is included (trash, water, sewer), what is billed separately, and how increases are handled.

Homes2Go’s San Antonio park roundup is a helpful reference for comparing communities and what to ask on tours.

4) Water damage and subfloor issues

If a home feels “soft” underfoot, smells musty, or shows staining around windows, bathrooms, or the ceiling, you may be looking at expensive repairs.

A cheap home with hidden moisture issues is rarely a bargain.

5) Overpaying for monthly payment comfort

Some buyers focus only on “Can I afford this monthly?” without asking “What am I paying overall?” Loan term and rate have huge effects on total cost.

The Consumer Financial Protection Bureau (CFPB) has plain-language education on housing and loan topics that can help you compare financing offers beyond the monthly number.

Financing moves that can keep your purchase genuinely affordable

You do not need a perfect financial profile to buy, but you do need a plan. The goal is to reduce risk for the lender and reduce long-term cost for you.

Get clarity on the home type and placement early

Financing can differ depending on whether the home is being placed on leased land or owned land, and whether it is titled as personal property or real property. You do not have to memorize the categories, but you should bring the placement plan to the lender conversation early.

Shop the “out-the-door” affordability, not the advertised rate

When comparing financing offers, make sure you understand:

- The total cash needed at closing

- Whether taxes and insurance are included in the payment

- Any required escrow or reserves

- Whether there are fees that change based on credit or down payment

Improve your file in the 30 days before you apply

If you are not ready today, a short preparation window can make a real difference.

- Pay down revolving balances if possible (even small reductions can help)

- Avoid opening new credit lines right before applying

- Gather income documentation and proof of stability

Homes2Go San Antonio can walk you through financing pathways and connect you with trusted local lenders (without you having to guess what programs fit your situation). If you want a local starting point, visit Homes2Go San Antonio.

Negotiation tips that actually work in manufactured home shopping

Negotiation is less about “winning” and more about getting a transparent, comparable offer.

Ask for an itemized quote you can compare line by line

Whether you are buying new or used, you want to see what is included and what is not.

A strong quote is clear about:

- Home price and included options

- Delivery scope

- Setup scope

- Any upgrades selected

- Estimated timeline assumptions

Negotiate on value, not just price

Sometimes the best deal is not a lower sticker price, it is having key costs included (or upgraded) so you do not pay for them later.

Examples of value items that may be worth discussing:

- Improved insulation or window package for comfort in Texas heat

- Better HVAC efficiency

- Inclusion of steps, skirting, or appliance package (when applicable)

Use comparable homes, not random online prices

Manufactured homes vary widely by build, options, and setup needs. “I saw one online for less” is not very persuasive unless it is truly comparable. Bring a like-for-like comparison.

Do a simple, repeatable inspection walkthrough (even if you hire a pro)

You do not need to be an expert to spot obvious red flags. On your walkthrough, pay special attention to:

- Floors that feel uneven, soft, or bouncy

- Signs of leaks under sinks and around tubs or showers

- Window and door alignment (sticky doors can signal movement)

- Ceiling staining, bubbling paint, or patchwork repairs

- Exterior siding condition and any signs of pests

- HVAC age and performance (if the system can be tested)

For modern manufactured homes, it is also smart to understand HUD labeling basics. HUD’s manufactured housing program overview is available through HUD.

If you are buying used, consider paying for a professional inspection or having a knowledgeable third party evaluate the home. A small upfront cost can protect you from a very expensive “cheap” purchase.

A quick comparison worksheet to pick the true bargain

When you are torn between two or three homes, use a consistent scoring method. Here is a lightweight worksheet you can copy into notes.

| Category | Home A | Home B | Home C |

|---|---|---|---|

| Total move-in cost estimate | |||

| Monthly land cost (rent or taxes) | |||

| Utility outlook (insulation, windows, HVAC) | |||

| Condition risk (roof, floors, plumbing) | |||

| Placement complexity (site work, access) | |||

| Timeline to move-in |

The “cheapest” home is usually the one with the best balance across all rows, not the one with the lowest number in the first row.

How Homes2Go San Antonio can help you buy cheaper, with less risk

If your goal is to find cheap manufactured homes for sale while still buying smart, the biggest advantage is having a clear process and local guidance.

Homes2Go San Antonio can help you:

- Compare home models and detailed floor plans

- Understand what is included in pricing, delivery, and setup quotes

- Explore flexible financing options through trusted local lenders

- Choose between community placement and land-based options

- Focus on energy-efficient designs that can lower long-term costs

If you are considering a land option near Elmendorf, you can also review the Sandy Oaks property details on the Homes2Go property page.

The fastest way to avoid expensive mistakes is to get a transparent, itemized picture of your real move-in costs early. Start browsing and get guidance at Homes2Go San Antonio.